Who can be an individual entrepreneur? What is individual entrepreneurship? Development of individual entrepreneurship

In order to make a profit from their labor and at the same time remain clean before the state, an individual, according to the legislation of the Russian Federation, registers with government agencies either by creating an enterprise or receiving the status of an individual entrepreneur. This procedure is established by the Civil Code of the Russian Federation and the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs”. Making a profit without going through such procedures will lead to the imposition of fines and other sanctions.

What individual entrepreneurship is is discussed in detail in the legislative acts of the Russian Federation.

An individual entrepreneur is an individual who runs a business and has passed state registration in the manner prescribed by law without forming a legal entity.

From the moment of receipt of registration forms, the work carried out by an individual entrepreneur for the purpose of making a profit is regulated by the same parts of the Civil Code of the Russian Federation as for legal entities, however, the processes of work and interaction with counterparties and other market participants are simplified.

Aspects of entrepreneurship:

- allows you to work and receive financial gain legally;

- expands the range of possibilities;

- assigns a certain responsibility;

- from the moment of state registration, an individual officially begins to conduct business, which means that delays and excuses can no longer be allowed.

As with any business, running a business as an individual entrepreneur has its advantages and disadvantages.

Positive aspects of going through the procedure of state registration of individual entrepreneurs:

- Registration of an individual entrepreneur is simpler than the establishment of a legal entity (regardless of the legal form of the latter).

- The owner decides the tasks of an individual entrepreneur independently; the state does not regulate accounting for such persons in a special manner, accounting policies, etc.

- The entrepreneur himself manages the activities without resorting to hiring a director.

- Cash disciplines for individual entrepreneurs are simplified in comparison with enterprises. Expenses of funds from an individual entrepreneur are directed at the discretion of the person, with the exception of cases when taxable profit is reduced due to expenses.

- Reporting to the Federal Tax Service and other government agencies requires less labor input when filling out and submitting.

- Does not require strict document management.

- It is not necessary to draw up a business plan to receive borrowed funds.

- There are fewer claims from government agencies regarding work organization issues, lower penalties, and fewer inspections than for legal entities.

- The ability to use state support programs (different for individual regions, details should be clarified in the structures of the subject of registration).

- The right to conclude foreign economic contracts, like legal entities.

Despite the positive aspects, an entrepreneur is the same responsible status as that of a founder when creating a legal entity.

But it doesn’t end with only positive aspects; there are also disadvantages, which rarely anyone thinks about at the beginning of their activity.

- It will not be possible to work with all customers, since for counterparties cooperation with an individual entrepreneur carries great risks if the latter fails to comply with its obligations.

- In case of bankruptcy and a large volume of credit obligations, debt collection occurs from the property of such an individual.

- There is a list of activities that an individual entrepreneur has no right to engage in.

- There is a restriction on hiring employees; their number is determined by the requirements for the selected tax regime.

- An individual entrepreneur is required to pay monthly insurance premiums for himself, regardless of whether he is already a pensioner or not.

- Obligations to submit reports to government authorities, including tax authorities, within the established time limits.

Despite all the nuances of operating as an individual entrepreneur, this is the only legal way to do business without organizing an enterprise.

When submitting and preparing tax reports without violating deadlines, maintaining accounting and engaging in legal activities, there will be no problems with government agencies.

Everything that passes through government bodies is always supported by legislative acts, the concept and activities of individual entrepreneurs are no exception.

Basic laws and codes that guide a novice businessman in his activities:

- Federal Law “On State Registration of Legal Entities and Entrepreneurs”.

- Tax Code of the Russian Federation and laws of the region of Russia in which state registration was carried out.

- The Law “On Licensing of Certain Types of Activities” and industry regulations, for example, legislation on tourism, if necessary.

- Federal Law "On".

- Federal Law No. 209 of July 24, 2007 “On the development of small and medium-sized businesses in the Russian Federation.”

- Labor Code – when using the labor of hired workers.

- Federal Law No. 54 of May 22, 2003 “On the use of cash registers and cash payments, as well as using plastic cards.”

The activities of an individual entrepreneur, despite their simplicity in comparison with legal entities, still impose on an individual quite a lot of responsibilities in accordance with the specified regulatory acts of the legislation of the Russian Federation.

Some types of activities are subject to additional regulations; the entrepreneur receives information about what other laws he needs to study when choosing his OKVED code.

Each entrepreneur is an independent person, and he has the right to choose a taxation system based on his own convictions, and also, if necessary, voluntarily change it in the manner prescribed by law.

A change in the tax regime for individual entrepreneurs may occur automatically due to exceeding the norms allowed by the current regime.

In total, the Tax Code defines 5 modes under which an individual entrepreneur can operate:

- OSNO (general taxation system) - implies maintaining full-fledged accounting records, paying income taxes, and filling out a large number of tax returns. At the same time, the entrepreneur gets the opportunity to conduct commercial activities without restrictions, recover VAT and engage in all types of activities, except those that are generally prohibited in the country or for individual entrepreneurs.

- STS (simplified taxation system). It also has a number of difficulties in terms of accounting, but it turns out to be simpler than OSNO. Within the framework of the simplified tax system, an entrepreneur can choose 2 tax base options: 6% of the total turnover or from 5 to 15% (the rate is determined by the laws of the constituent entity of the Russian Federation in which the activity is carried out) of income minus expenses. In this case, there are some restrictions.

- UTII (imputed tax). May be applicable by some individual entrepreneurs for state-defined types of activities. In this case, taxation is determined by the rate established by the state using coefficients. The mode has restrictions, so it is used by entrepreneurs less often than others.

- Patent system. Most often used by entrepreneurs involved in trade to the final consumer and the provision of services to the public. The tax in this case is fixed, accounting is limited to filling out a ledger of income and expenses. It has strict limits in terms of income, staff and OKVED.

- Unified Agricultural Sciences. Suitable for agricultural producers only.

Individual entrepreneurs have the right to apply several forms of taxation simultaneously, for certain types of activities. This allows you not to exceed the limits established by law under the simplified tax system and patent, and to avoid restrictions on engaging in one or another type of business.

Due to the fact that individual entrepreneurship is a simplified form of state business registration, it has a number of limitations. May be applicable to all entrepreneurs or depending on the chosen taxation system.

Due to the fact that individual entrepreneurship is a simplified form of state business registration, it has a number of limitations. May be applicable to all entrepreneurs or depending on the chosen taxation system.

OKVED involves dividing all types of activities into 4 groups:

- permitted - all entrepreneurs and legal entities can engage in them without additional restrictions and approvals;

- licensed - you can work in the field of these codes only by obtaining a special license from the relevant government bodies;

- prohibited - types of activities that can be carried out by a limited number of enterprises (most often the public sector);

- unlicensed, but requiring additional permits - it is possible to conduct activities under these OKVED codes only by obtaining permits from regulatory authorities (for example, a sanitary station for public catering), and are available for individual entrepreneur registration.

Prohibited types of activities that, regardless of the form of taxation, individual entrepreneurs cannot engage in:

- production and wholesale of alcoholic beverages;

- production of narcotic drugs, psychotropic and pharmaceutical drugs;

- sale of electricity to civilians;

- space activities (flights);

- activities in the segment of non-state pension insurance and investment funds;

- employment of citizens of the Russian Federation abroad;

- establishment of security companies and provision of related services;

- air transportation;

- conducting examinations in the field of industrial safety;

- activities aimed at managing hydrometeorological or geophysical processes;

- production and distribution of explosives and pyrotechnic products;

- storage, production, sale and development of ammunition, weapons and components, including chemicals;

- development and production of aviation equipment and dual-use equipment, its repair and maintenance.

You will need to obtain a license before starting work for the following activities:

- Pharmaceuticals.

- Sales of tobacco products.

- Private detective activities.

- Transportation by land or sea transport, etc., if provided by law.

Depending on the form of taxation, restrictions on work may also be imposed.

Table 1. Limitations on the activities of individual entrepreneurs based on the tax base chosen during registration

| Limitation | BASIC | simplified tax system | UTII* | Patent |

| State | No limits | Up to 100 people | No more than 100 | Up to 10 people |

| Annual turnover, rub. | Not installed | 150 million | No | 60 million |

| Everything is allowed, except those prohibited by the state for individual entrepreneurs | It is prohibited to establish legal services firms, pawnshops and conduct gambling business. | Can only be used for the types of activities specified in clause 2 of Art. 346.26 ch. 26.3 Tax Code of the Russian Federation | All are prohibited, except those provided for in paragraph 2 of Art. 346 of Chapter 26.4 of the Tax Code of the Russian Federation as patent activities. |

*According to UTII, the Tax Code of the Russian Federation has a number of additional restrictions, including the size of retail premises should not exceed 150 square meters. m, the number of cars in the fleet for individual entrepreneurs providing transportation services cannot exceed 20 units.

It is preferable for an individual entrepreneur to decide on the types of activities and form of taxation before undergoing state registration. Restrictions on certain OKVED will not allow you to operate within the law and obtain the necessary certificates, and for violation of these parts of the law, criminal liability is provided.

If everything with the types of activities and the form of taxation has been decided, then the entrepreneur must go through the procedure of mandatory state registration; for this, the following is submitted to the registration authority:

- Statement of the established form.

- Passport of a citizen of the Russian Federation or a foreigner (with translation).

- Taxpayer identification number.

- And other forms established for certain categories of individuals.

Within 5 days after submitting the full package of papers, if there are no claims against the entrepreneur from government agencies, he receives a certificate of state registration, and information about him is entered into the register, where all data about the individual entrepreneur will be stored until the termination of activity.

Within 5 days after submitting the full package of papers, if there are no claims against the entrepreneur from government agencies, he receives a certificate of state registration, and information about him is entered into the register, where all data about the individual entrepreneur will be stored until the termination of activity.

An individual, regardless of citizenship, who has reached the age of majority and is recognized as legally capable, can become an individual entrepreneur. For foreigners, it is mandatory to have documents confirming the legal grounds for staying on the territory of the Russian Federation (TRP or permanent residence permit).

In some cases, individual entrepreneur status can be obtained by persons under 18 years of age if they are recognized by authorized bodies as adults ahead of schedule, as a result of marriage, or with permission from parents or other legal representatives (guardians).

Individual entrepreneurs, as well as legal entities, have the right to use the labor of hired workers. In order to gain the legal opportunity to hire people to perform work, an individual entrepreneur (the requirements were in force until 2017) must go through the procedure of registering as an employer with the Pension Fund, FFOMS and Social Insurance Fund, having received the appropriate certificates.

Since 2017, an individual entrepreneur is required only when employing the first employee to submit information to the Social Insurance Fund that he has begun an employment relationship with an individual. This must be done within the time period established by law – 30 calendar days. Otherwise, fines are provided for 90 days of delay - 5,000 rubles, over - 10,000 rubles.

The sequence of actions for registering an employee as an individual entrepreneur is not very different from the standard procedure at enterprises of other forms of ownership:

The sequence of actions for registering an employee as an individual entrepreneur is not very different from the standard procedure at enterprises of other forms of ownership:

Accept from the future employee a package of documents that includes:

- Passport of a citizen of the Russian Federation, or an alternative, for foreign citizens. Employment of foreigners involves the preparation of an expanded package, with the attachment of permit forms, as well as the completion of additional procedures, including at the Federal Migration Service;

- SNILS;

- employment history;

- education diploma and certificates (if required to perform work).

If an individual has not previously been employed, registration of SNILS and a work book is the obligation of the individual entrepreneur as the first employer for such an employee:

- Accept the application for registration with the state.

- Draw up an employment or civil law contract (used only for one-time work, in this case a work book is not required).

- Issue an order for recruitment and commencement of work duties.

- Create a personal employee card.

- No later than a week from the moment of signing the employment contract, make an entry in the work book.

If the employee did not work for 5 days and quit, an entry in the employment record may not be made.

Termination of IP

In cases where an individual entrepreneur decides to stop conducting business activities, he must close the individual entrepreneur in accordance with the procedure established by law. The procedure for terminating a business, as well as registration, is regulated by the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs.” The procedure is determined by Art. 22.3 of the said act. In cases of forced termination of activity or death of an individual entrepreneur, registration authorities are guided by data received from government agencies, courts or notaries.

As for the voluntary procedure, the individual entrepreneur must submit the following documents to the structures:

- An application completed in the prescribed manner.

- Payment confirming payment of the state duty.

- Evidence that he submitted the necessary documents to the Pension Fund.

Until the official termination of business activities, an individual remains obligated to pay taxes and fees provided for by law, regardless of whether business is being conducted or not, so it is worth considering that such termination of work is unacceptable for the individual entrepreneur himself.

Conducting activities and receiving financial benefits from them in Russia without going through state registration procedures is an illegal form of income. At the same time, the formation of an enterprise is a complex and lengthy process. If the type of business activity allows it, then most individuals choose to register as an individual entrepreneur. The opportunities obtained in this case are slightly less than those of legal entities, and there are no complaints from authorities and order.

Individual entrepreneur (IP)(obsolete private entrepreneur (PE), PBOYUL until 2005) is an individual registered as an entrepreneur without forming a legal entity, but in fact possessing many of the rights of legal entities. The rules of the civil code regulating the activities of legal entities apply to individual entrepreneurs, except in cases where separate articles of laws or legal acts are prescribed for entrepreneurs.()

Due to some legal restrictions (it is impossible to appoint full-fledged directors to branches in the first place), an individual entrepreneur is almost always a micro-business or small business.

according to the Code of Administrative Offenses

Fine from 500 to 2000 rubles

In case of gross violations or when working without a license - up to 8,000 rubles. And, it is possible to suspend activities for up to 90 days.

From RUB 0.9 million for three years, and the amount of arrears exceeds 10 percent of the tax payable;

From 2.7 million rubles.

Fine from 100 thousand to 300 thousand rubles. or in the amount of the culprit’s salary for 1-2 years;

Forced labor for up to 2 years);

Arrest for up to 6 months;

Imprisonment for up to 1 year

If the individual entrepreneur fully pays the amounts of arrears (taxes) and penalties, as well as the amount of the fine, then he is exempt from criminal prosecution (but only if this is his first such charge) (Article 198, paragraph 3 of the Criminal Code)

Evasion of taxes (fees) on an especially large scale (Article 198, paragraph 2. (b) of the Criminal Code)

From 4.5 million rubles. for three years, and the amount of arrears exceeds 20 percent of the tax payable;

From 30.5 million rubles.

Fine from 200 thousand to 500 thousand rubles. or in the amount of the culprit’s salary for 1.5-3 years;

Forced labor for up to 3 years;

Imprisonment for up to 3 years

Fine

If the amounts for criminal prosecution are not reached, then there will only be a fine.

Non-payment or incomplete payment of taxes (fees)

1. Non-payment or incomplete payment of tax (fee) amounts as a result of understatement of the tax base, other incorrect calculation of tax (fee) or other unlawful actions (inaction) entails a fine in the amount of 20 percent of the unpaid amount of tax (fee).

3. The acts provided for in paragraph 1 of this article, committed intentionally, entail a fine in the amount of 40 percent of the unpaid amount of tax (fee). (Article 122 of the Tax Code)

Penalty

If you were just late in payment (but did not provide false information), then there will be penalties.

The penalties for everyone are the same (1/300 multiplied by the key rate of the Central Bank per day of the amount of non-payment) and now amount to about 10% per annum (which is not very much in my opinion, considering that banks give loans for at least 17-20 %). You can count them.

Licenses

Some types of activities an individual entrepreneur can only engage in after receiving a license, or permissions. Licensed activities of individual entrepreneurs include: pharmaceutical, private investigation, transportation of goods and passengers by rail, sea, air, as well as others.

An individual entrepreneur cannot engage in closed types of activities. These types of activities include the development and/or sale of military products, trafficking in narcotic drugs, poisons, etc. Since 2006, the production and sale of alcoholic beverages has also been prohibited. An individual entrepreneur cannot engage in: production of alcohol, wholesale and retail trade in alcohol (with the exception of beer and beer-containing products); insurance (i.e. be an insurer); activities of banks, investment funds, non-state pension funds and pawnshops; tour operator activities (travel agency is possible); production and repair of aviation and military equipment, ammunition, pyrotechnics; production of medicines (sales possible) and some others.

Differences from legal entities

- The state fee for registering individual entrepreneurs is 5 times less. In general, the registration procedure is much simpler and fewer documents are required.

- An individual entrepreneur does not require a charter and authorized capital, but he is liable for his obligations with all his property.

- An entrepreneur is not an organization. It is impossible for an individual entrepreneur to appoint a full and responsible director.

- Individual entrepreneurs do not have cash discipline and can manage the funds in the account as they wish. Also, the entrepreneur makes business decisions without recording them. This does not apply to working with cash registers and BSO.

- An individual entrepreneur registers a business only in his name, in contrast to legal entities, where registration of two or more founders is possible. Individual entrepreneurship cannot be sold or re-registered.

- A hired employee of an individual entrepreneur has fewer rights than a hired employee of an organization. And although the Labor Code equates organizations and entrepreneurs in almost all respects, there are still exceptions. For example, when an organization is liquidated, the mercenary is required to pay compensation. When closing an individual entrepreneur, such an obligation exists only if it is specified in the employment contract.

Appointment of director

It is legally impossible to appoint a director in an individual entrepreneur. The individual entrepreneur will always be the main manager. However, you can issue a power of attorney to conclude transactions (clause 1 of Article 182 of the Civil Code of the Russian Federation). Since July 1, 2014, it has been legislatively established for individual entrepreneurs to transfer the right to sign an invoice to third parties. Declarations could always be submitted through representatives.

All this, however, does not make the people to whom certain powers are delegated directors. A large legislative framework on rights and responsibilities has been developed for directors of organizations. In the case of an individual entrepreneur, one way or another, he himself is responsible under the contract, and with all his property he himself is responsible for any other actions of third parties by proxy. Therefore, issuing such powers of attorney is risky.

Registration

State registration of an individual entrepreneur carried out by the Federal Tax Service of the Russian Federation. The entrepreneur is registered with the district tax office at the place of registration, in Moscow - MI Federal Tax Service of the Russian Federation No. 46 for Moscow.

Individual entrepreneurs can be

- adult, capable citizens of the Russian Federation

- minor citizens of the Russian Federation (from 16 years of age, with the consent of parents, guardians; married; a court or guardianship authority has made a decision on legal capacity)

- foreign citizens living in the Russian Federation

OKVED codes for individual entrepreneurs are the same as for legal entities

Necessary documents for registration of an individual entrepreneur:

- Application for state registration of an individual entrepreneur (1 copy). Sheet B of form P21001 must be filled out by the tax office and given to you.

- A copy of the Taxpayer Identification Number.

- A copy of your passport with registration on one page.

- Receipt for payment of the state fee for registration of an individual entrepreneur (800 rubles).

- Application for switching to the simplified tax system (If you need to switch).

An application for registration of individual entrepreneurs and other documents can be prepared online in a free service.

Within 5 days you will be registered as an individual entrepreneur or you will receive a refusal.

You must be given the following documents:

1) Certificate of state registration of an individual as an individual entrepreneur (OGRN IP)

2) Extract from the Unified State Register of Individual Entrepreneurs (USRIP)

After registration

After registering an individual entrepreneur It is necessary to register with the pension fund and the Compulsory Medical Insurance Fund and obtain statistics codes.

Also necessary, but optional for an entrepreneur, is opening a current account, making a seal, registering a cash register, and registering with Rospotrebnadzor.

Taxes

Individual entrepreneur pays a fixed payment to the pension fund for the year, 2019 - 36,238 rubles + 1% of income over 300,000 rubles, 2018 - 32,385 rubles + 1% of income over 300,000 rubles. The fixed contribution is paid regardless of income, even if the income is zero. To calculate the amount, use the IP fixed payment calculator. There are also KBK and calculation details.

An individual entrepreneur can apply tax schemes: simplified tax system (simplified), UTII (imputed tax) or PSN (patent). The first three are called special modes and are used in 90% of cases, because they are preferential and simpler. The transition to any regime occurs voluntarily, upon application; if you do not write applications, then OSNO (general taxation system) will remain by default.

Taxation of an individual entrepreneur almost the same as for legal entities, but instead of income tax, personal income tax is paid (under OSNO). Another difference is that only entrepreneurs can use PSN. Also, individual entrepreneurs do not pay 13% on personal profits in the form of dividends.

An entrepreneur has never been obliged to keep accounting records (chart of accounts, etc.) and submit financial statements (this only includes a balance sheet and a financial performance statement). This does not exclude the obligation to keep tax records: declarations of the simplified tax system, 3-NDFL, UTII, KUDIR, etc.

An application for the simplified tax system and other documents can be prepared online in a free service.

Inexpensive programs for individual entrepreneurs include those with the ability to submit reports via the Internet. 500 rubles/month. Its main advantage is ease of use and automation of all processes.

Help

Credit

It is more difficult for an individual entrepreneur to get a loan from a bank than for a legal entity. Many banks also give mortgages with difficulty or require guarantors.

- An individual entrepreneur does not keep accounting records and it is more difficult for him to prove his financial solvency. Yes, there is tax accounting, but profit is not allocated there. Patent and UTII are especially opaque in this matter; these systems do not even record income. The simplified tax system “Income” is also unclear, because it is not clear how many expenses there are. The simplified tax system "Income-Expenditures", Unified Agricultural Tax and OSNO most clearly reflect the real state of the individual entrepreneur's business (there is an accounting of income and expenses), but unfortunately these systems are used less frequently.

- The individual entrepreneur himself (as opposed to the organization) cannot act as collateral in the bank. After all, he is an individual. The property of an individual can be collateral, but this is legally more complicated than collateral from an organization.

- An entrepreneur is one person - a person. When issuing a loan, the bank must take into account that this person can get sick, leave, die, get tired and decide to live in the country, giving up everything, etc. And if in an organization you can change the director and founders with the click of a finger, then in this case an individual entrepreneur can just close it and terminate the loan agreement or go to court. IP cannot be re-registered.

If a business loan is denied, then you can try to take out a consumer loan as an individual, without even disclosing your plans to spend money. Personal loans usually have high rates, but not always. Especially if the client can provide collateral or has a salary card with this bank.

Subsidy and support

In our country, hundreds of foundations (state and not only) provide consultations, subsidies, and preferential loans for individual entrepreneurs. Different regions have different programs and help centers (you need to search). .

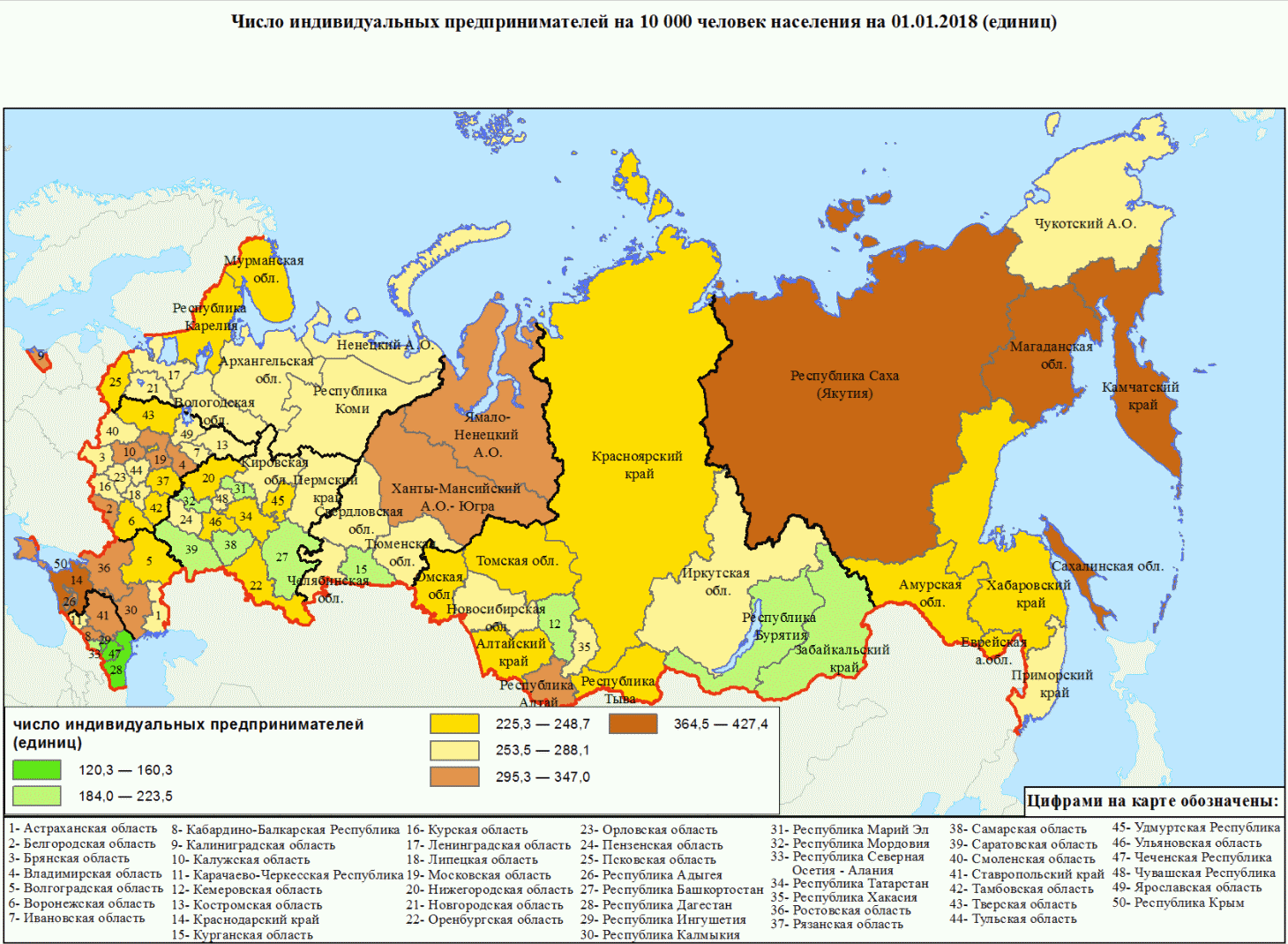

Rice. Number of individual entrepreneurs per 10,000 population

Experience

Pension experience

If the entrepreneur pays everything regularly to the Pension Fund, then the pension period runs from the moment of state registration until the closure of the individual entrepreneur, regardless of income.

Pension

According to current legislation, an individual entrepreneur will receive a minimum pension, regardless of how many contributions to the Pension Fund he pays.

The country is undergoing almost continuous pension reform and therefore it is not possible to accurately determine the size of the pension.

Since 2016, if a pensioner has the status of an individual entrepreneur, then his pension will not be indexed.

Insurance experience

The insurance period for the Social Insurance Fund only applies if the entrepreneur voluntarily pays contributions to the social insurance (FSS).

Difference from employees

The Labor Code does not apply to the individual entrepreneur himself. It is accepted only for hired workers. An individual entrepreneur, unlike a director, is not a mercenary.

Theoretically, an individual entrepreneur can hire himself, set a salary and make an entry in the work book. In this case, he will have all the rights of an employee. But it is not recommended to do this, because... then you will have to pay all salary taxes.

Only a female entrepreneur can receive maternity leave and only under the condition of voluntary social insurance. .

Any businessman, regardless of gender, can receive an allowance of up to one and a half. Either in RUSZN or in the FSS.

Individual entrepreneurs are not entitled to leave. Because he has no concept of working time or rest time and the production calendar also does not apply to him.

Sick leave is granted only to those who voluntarily insure themselves with the Social Insurance Fund. Calculated based on the minimum wage, the amount is insignificant, so in social insurance it makes sense only for mothers on maternity leave.

Closing

Liquidation of an individual entrepreneur is an incorrect term. An entrepreneur cannot be liquidated without violating the Criminal Code.

Closing an individual entrepreneur occurs in the following cases:

- in connection with the adoption of a decision by an individual entrepreneur to terminate activities;

- in connection with the death of a person registered as an individual entrepreneur;

- by court decision: forcibly

- in connection with the entry into force of a court verdict of deprivation of the right to engage in entrepreneurial activity;

- in connection with the cancellation of a document (overdue) confirming the right of this person to reside in Russia;

- in connection with a court decision to declare an individual entrepreneur insolvent (bankrupt).

Databases on all individual entrepreneurs

Website Contour.Focus

Partially free Contour.Focus The most convenient search. Just enter any number, last name, title. Only here you can find out OKPO and even accounting information. Some information is hidden.

Extract from the Unified State Register of Individual Entrepreneurs on the Federal Tax Service website

For free Federal Tax Service database Unified State Register of Individual Entrepreneurs (OGRNIP, OKVED, Pension Fund number, etc.). Search by: OGRNIP/TIN or full name and region of residence (patronymic name does not have to be entered).

Bailiffs Service

For free FSSP Find out about enforcement proceedings for debt collection, etc.

With help, you can keep tax records on the simplified tax system and UTII, generate payment slips, 4-FSS, Unified Settlement, SZV-M, submit any reports via the Internet, etc. (from 325 rubles/month). 30 days free. Upon first payment. For newly created individual entrepreneurs now (free).

Question answer

Is it possible to register using temporary registration?

Registration is carried out at the address of permanent residence. To what is indicated in the passport. But you can send documents by mail. According to the law, it is possible to register an individual entrepreneur at the address of temporary registration at the place of stay, ONLY if there is no permanent registration in the passport (provided that it is more than six months old). You can conduct business in any city in the Russian Federation, regardless of the place of registration.

Can an individual entrepreneur register himself for work and make an entry in his employment record?

An entrepreneur is not considered an employee and does not make an entry in his employment record. Theoretically, he can apply for a job himself, but this is his personal decision. Then he must conclude an employment contract with himself, make an entry in the work book and pay deductions as for an employee. This is unprofitable and makes no sense.

Can an individual entrepreneur have a name?

An entrepreneur can choose any name for free that does not directly conflict with the registered one - for example, Adidas, Sberbank, etc. The documents and the sign on the door should still have the full name of the individual entrepreneur. He can also register the name (register a trademark): this costs more than 30 thousand rubles.

Is it possible to work?

Can. Moreover, you don’t have to tell them at work that you have your own business. This does not affect taxes and fees in any way. Taxes and fees to the Pension Fund must be paid - both as an individual entrepreneur and as a mercenary, in full.

Is it possible to register two individual entrepreneurs?

An individual entrepreneur is just the status of an individual. It is impossible to simultaneously become an individual entrepreneur twice (to obtain this status if you already have it). There is always one TIN.

What are the benefits?

There are no benefits in entrepreneurship for people with disabilities and other benefit categories.

Some commercial organizations also offer their own discounts and promotions. Online accounting Elba for newly created individual entrepreneurs is now free for the first year.

In our country, starting a business legally is not difficult. It is enough to first collect the necessary ones and study them. According to statistics for 2017, about 4 million individual entrepreneurs are registered in Russia. However, individual entrepreneurs need to remember that they not only have the right to make a profit, but also corresponding responsibilities, for failure to comply with which sanctions and fines are imposed. In today's article we will tell you who individual entrepreneurs are, what they do, and what responsibilities they have.

Page content

An individual entrepreneur is an individual who conducts independent business activities with the aim of obtaining systematic profit without education, and has passed the state registration procedure established by law.

Previously, the terms PE “private entrepreneur” and PBOYUL “entrepreneur without forming a legal entity” were used. Now these terms are combined into IP.

Individual entrepreneurs in our country can become:

- capable persons who have reached 18 years of age;

- legally competent minors who have reached the age of 16 (with the consent of their parents or guardians, who have entered into marriage);

- foreign citizens living in the Russian Federation.

IMPORTANT: a state or municipal employee cannot be an entrepreneur.

Why register an individual entrepreneur?

In our country, millions of people are engaged in their own business. In principle, there is nothing wrong with this if you are not engaged in prohibited activities, and your “home” business does not require renting premises or concluding contracts with suppliers. Most often, an example is the services provided by self-trained craftsmen, such as: accounting, copywriting, manicure and hairstyles, massage, apartment rental, taxi with your own car, repair of apartments, cars, computers and others. Of course, in this case you do not pay and do not deal with paperwork.

Pros of registering an individual entrepreneur

- By registering an individual entrepreneur legally, you can conduct business with a clear conscience;

- The procedure is either very simple and done quickly;

- The range of possible activities carried out is much wider;

- The pension period is in progress, as you pay into the pension fund;

- You can get a loan for a small business on more favorable terms than for an individual.

Disadvantages of registering an individual entrepreneur

- in case of bankruptcy and debt formation, the individual entrepreneur is liable with all his property, that is, the court will take away everything that can be taken away by law;

- some companies that pay VAT do not want to use the services of individual entrepreneurs due to conflicting taxation systems, leading to the fact that the “big” company actually pays this tax for the entrepreneur;

- An individual entrepreneur cannot register a business together with someone else. He is the sole owner of the business and cannot even hire an employee as a director;

- An individual entrepreneur is obliged to make social payments in a fixed amount constantly and regularly, regardless of the level of profit (even if the work is at a loss);

The individual entrepreneur pays a fixed payment to the pension fund, which does not depend on his income level. The pension contribution in 2019 is 22,261.38 rubles per year plus 1% of income if it exceeds 300,000 rubles.

An individual entrepreneur can carry out activities at a rate of 6%. However, he does not pay 9% of profits in the form of dividends.

Individual entrepreneurs are exempt from maintaining complex accounting records. He only maintains tax reporting: USN, 3-NDFL, UTII, KUDIR

If an individual entrepreneur regularly pays pension contributions, then his length of service goes from the opening of the individual entrepreneur to its closure, also regardless of the level of profit.

A female entrepreneur has the right to receive maternity leave if she has made voluntary insurance contributions to social insurance.

Child benefit for a child under 1.5 years old can be received by individual entrepreneurs of any gender.

An individual entrepreneur can receive sick leave if he has made voluntary contributions to social insurance. However, the amount of sick leave is calculated based on the minimum wage, the amount of which is established by law. Therefore, these payments will be insignificant.

Individual entrepreneurs are not entitled to leave.

Thus, along with the rights, individual entrepreneurs also have an extensive list of responsibilities to the state. Note that individual entrepreneur is the most popular type of registration of legal activities in small businesses. As you can see, there are some nuances, pros and cons. If you want to start your own business, you will have to understand the nuances and take action.

Remember that ignorance of the laws does not exempt you from complying with them, much less from fines. Therefore, it is necessary to know the amounts of mandatory payments, rules for hiring employees, etc. And also for individual entrepreneurs it is desirable, but optional, after registration, and.

(IP) is one of the ways to generate income using your own capabilities and strengths. This is very relevant, for example, if you are a teacher who is able to tutor, give individual or group lessons, or an artist, writer, photographer. For people with land, there is an opportunity to grow vegetables and receive profit from sales.

Basic concept

Let's figure out what an individual entrepreneur is. This is a form of small business. are individuals who are registered in a certain manner established by law. They can carry out their private activities without forming a legal entity. Previously, in Russia they used the equivalent concepts of PE PBOYUL (without the formation of a legal entity). Nowadays, these terms have been replaced by the concept of individual entrepreneurs. What is an individual entrepreneur and why is its registration necessary? This procedure is of great importance if you want to earn money legally. Registration of an individual entrepreneur takes place at the individual’s place of residence. However, he can carry out his activities at other addresses.

There is one more feature that not everyone knows about: the place of residence should not be used for activities that are related to any industrial production. The fact is that it is intended only for the residence of citizens. But this provision must be interpreted restrictively: it does not prohibit activities in these premises that do not contradict the rights of all persons living there and neighbors. For example, if your activity is related to intellectual work, for example, collecting data, writing scientific papers or drawing, programming, accounting, tutoring, auditing, consulting, then this can be done at your place of residence without breaking the law. In addition, as noted above, you can live at one address and conduct your business in another place.

When do people think about entrepreneurship?

Many people begin to think about what an individual entrepreneur is only when they begin to be dissatisfied with something in the work of an ordinary employee at an enterprise. I would like to have more income. At the beginning of independent work, you will have to work hard to achieve a good profit. But if everything works out, then in the future the person will become independent. There will be no need to work for the owner, since in this case you yourself are your own boss. The law allows only adults to engage in entrepreneurship. An individual who operates as an individual entrepreneur must be registered under his own name. It is an independent subject of business and civil law, like any commercial organization. After registration, a person is the owner of the labor force with the tools of production; he can independently organize his work and manage its results. So, what is an IP? This is an opportunity to become an independent worker within the limits of the law.

New in IP since 2013

From this year there is no need to provide the following reports to the tax authorities:

Quarterly.

Six months.

For 9 months of work.

For individual entrepreneurs, other significant changes occurred in 2013. The amount of the insurance (fixed) premium has increased. You can reduce the amount of the single tax by the amount of contributions under the insurance contract. New concepts have appeared: patent activity and deflator coefficient. However, many entrepreneurs have decided to leave business this year, since social contributions for them have almost doubled.

Registration and operation of an individual entrepreneur has a number of risks, but it provides the opportunity to start your own business, which allows you to become independent!

It is no secret that their business is most often organized by those who, due to psychological characteristics, are unable to work “for someone else”, carry out the instructions of a superior manager day after day and do not fully feel the final result of their work. Therefore, he will always find his own niche. This way of doing business is always in demand, because there are many branches of economic activity where large business entities are simply not needed.

A little history

Individual entrepreneurship in Russia began to develop quite a long time ago and has a rich history. After all, one of the main activities of the Slavic peoples was trade. Under Peter the Great, for example, Russian merchants were well known far beyond the borders of Russia, and traditional fairs attracted “entrepreneurs” from all corners of the great power. The further development of individual entrepreneurship during the reign of Catherine the Second was due to the complete abolition of monopolies and maximum freedom of trade. It should be especially noted that during this period even peasants were allowed to carry out entrepreneurial activities, and after the reforms of Alexander the Second and the abolition of serfdom, they received unprecedented opportunities for doing business.

Unfortunately, after the revolution of 1917, a “black period” began in the history of private entrepreneurship, which lasted almost 70 years. In the Soviet Union, entrepreneurs were considered speculators and were held accountable. But already in 1987, in the light of changes and the ensuing period of perestroika, the law “On Individual Labor Activity” was adopted, which marked the beginning of the revival of business in Russia.

So who is he?

An individual entrepreneur is considered by law as an individual who carries out business activities in the prescribed manner without forming a legal entity.

The following have the right to carry out such activities:

- citizens of the Russian Federation who have reached the age of 18, if their legal capacity has not been limited in court;

- under the age of majority: in case of marriage; availability of permission from parents, guardians, adoptive parents to conduct business activities; based on a court decision on full legal capacity; announcements by the guardianship and trusteeship authorities that the person has been recognized as fully capable;

- stateless persons, as well as foreigners: if they temporarily or permanently reside in the country.

However, such type of activity as individual entrepreneurship cannot be registered by municipal workers and civil servants.

Duties and Responsibilities

An individual entrepreneur, just like a commercial legal entity, conducts business at its own discretion and bears full personal and financial responsibility within the limits of current legislation. Moreover, an entrepreneur who fails to fulfill his obligations bears responsibility regardless of guilt. Like a legal entity, they are subject to inspections by the tax inspectorate and other regulatory authorities. If a private owner has hired employees, he is obliged to enter into an employment contract and pay all taxes and fees in the same way as a commercial legal entity.

The main differences between an individual entrepreneur and a commercial legal entity

Despite the fact that these forms of business activity are quite similar, differences still exist. For example, individual business entities can use business income at their own discretion and in full, while a commercial organization can only count on quarterly dividends.

The individual form of doing business does not require mandatory accounting; maintaining a cash book is sufficient. Also, to register an individual entrepreneur, you do not need start-up capital; it is enough to pay a state fee, and in general, you need to complete a much smaller package of documents. To run an individual business, it is not at all necessary to open a current account and register a company seal, although this is not prohibited, but there are no restrictions on cash payments.

Features of taxation

The activities of both individuals and legal entities are regulated by the same provisions of the Tax Code, therefore the individual entrepreneur is obliged to register as a taxpayer and independently transfer all due deductions. However, an individual entrepreneur is a small business entity, and therefore he has the opportunity to choose a taxation and reporting system. And the choice is quite wide. Most often, one of three systems is used:

- ordinary taxation system (OSNO) - provides for the payment of VAT, personal income tax. persons and the unified social tax;

- simplified system (STS) - in the event that an individual entrepreneur does not have hired employees and carries out only one type of business activity;

- unified tax on imputed income (UTII) - the activity itself, and not the business entity, is taxed; it is calculated based on the provisions of local legislation and within the limits of the list regulated by Article 346.26 of the Tax Code.

Classification

As you know, everything that is not prohibited by law is permitted. Therefore, an individual entrepreneur can do whatever he wants, as long as it does not contradict the law. Depending on the type of occupation, types of individual entrepreneurship can be divided into:

- Licensed: requiring special permission from the relevant authorities - a license that is issued by the competent authority after certain requirements are met. These include, for example, detective, pharmaceutical, geodetic, cartographic activities and much more.

- Requiring special approval - a license is not required to carry out such activities, but it must be agreed upon, for example, with the sanitary service or obtain permission from the Ministry of Emergency Situations.

In addition, there is a list of activities that individual entrepreneurship completely excludes, for example, production, disposal and repair of military equipment and weapons, pyrotechnic products, production of medicines, alcoholic beverages, sale of electricity, etc.

Activities that can be carried out immediately after registering an individual entrepreneur’s certificate are classified as ordinary (unlicensed). The main criterion for inclusion in this category is the absence of harm or threat to the life and health of citizens.

Advantages of IP

By researching and analyzing individual entrepreneurship, we can highlight several undeniable advantages:

- high adaptation to local market conditions;

- ample opportunities to implement business ideas;

- fairly low costs of management and business activities;

- simplified accounting;

- concentration of profits in one hand;

- higher capital turnover rate;

- the ability to operate with relatively small capital;

- high ability to make changes to goods and services, adapting to market needs.

Well, how can there be no shortcomings?

Of course, like any other type of business, individual entrepreneurship cannot consist only of advantages. The disadvantages of this form of doing business include:

- high level of risk, unstable market position;

- high probability of insufficient competence of management;

- difficulties in attracting third-party funds, possible complications when obtaining a loan;

- increased risks when concluding contracts;

- dependence on larger companies, low competitiveness;

- in case of failure, property liability also extends to the owner’s personal property.

However, the individual form of entrepreneurship is becoming increasingly popular and in demand.

New articles

- Events after the reporting date

- Who must pay income tax and in what cases?

- International Financial Reporting Standards

- What is individual entrepreneurship?

- Industry and mineral resources

- Syria's place in the global economy

- ” and options for greetings and farewells

- Where are accounts receivable reflected?

- A decrease in accounts payable indicates

- Simplified balance sheet: example of filling

Popular articles

- Historical pages of France - The Hundred Years' War Stage 2 of the Hundred Years' War

- Templar cross - what does this amulet contain? Secret ritual for a Templar coin

- Download the book “How to Work Four Hours a Week” (Timothy Ferris) in PDF, FB2, ePub and other formats Will I have to quit my job?

- Ten Commandments of God in Orthodoxy

- A strong prayer to the guardian angel

- International disability statistics How many disabled people are there in the world?

- Training under the program “Auditor Certificate” The auditor qualification certificate must be issued

- Russian Federation budget income and expenses table

- Top 10 scary pictures. Myth or curse? Stories of the most terrible paintings. "Hands Reach", Bill Stoneham

- Codes for money and luck: how to attract success using numbers Codes for attracting money